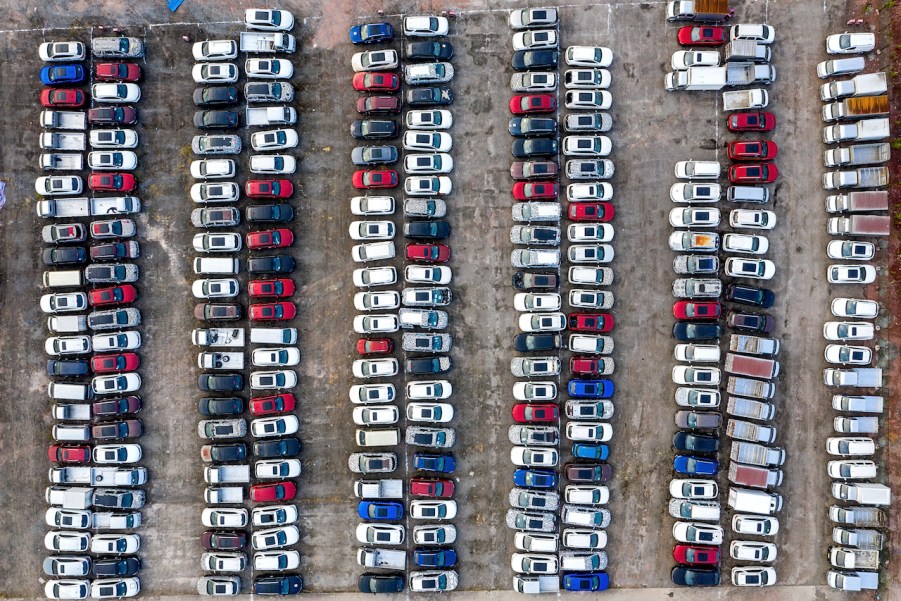

Americans Owe Almost $1,200 Billion in Outstanding Auto Loans

While the global economy begins to recover slightly from the impact of the ongoing Covid-19 pandemic, the world of auto loans is in trouble. Most buyers opt for a car loan when purchasing a vehicle rather than paying it in full. As a result, when the economy struggles, late payments become more common. According to Car & Driver, citing the Federal Reserve Bank of St. Louis, the auto loan industry is in such bad shape that there are currently almost $1,200 billion owed on outstanding auto loans.

Deferred payments could be a contributing factor

In response to the economic downturn felt globally in 2020, some lenders allowed auto loan holders to defer their payments. Although delaying a payment does not decrease the overall balance of the loan, it gives people some much-needed breathing room. One downside of this action, however, is that the loans themselves retain the same owed balance. The result is that the national amount on outstanding auto loans increases as Americans purchase new cars, but isn’t decreasing at the same rate.

Thankfully, the national average of loans in forbearance programs decreased from 6.2 percent in July to 4.3 percent in August, according to a TransUnion report. While the situation may seem quite gloomy, these numbers seem to be pointing in the right direction. As Americans stabilize their homes financially, they are beginning to catch back up with their outstanding payments to keep them away from collections, hopefully.

Americans are starting to buy brand-new cars again

The auto loan and new car industries suffered significant dips during the first two quarters of 2020. New third quarter sales data shows that some models managed to increase sales during that time. While it may be confusing to see, it highlights that while many people have fallen into hard times, others are taking advantage of aggressive incentives and signing up for more auto loans.

The long-lasting effects of the ongoing global pandemic could potentially lead to a wave of people defaulting on their loans. The TransUnion report also noted an increase in both auto loans and mortgages that were over 30 days past due. 53 percent of people responded to a TransUnion survey stating that they were paying their auto and home loans normally. Despite this, 14 percent also answered, saying they had no idea how they would make their next payment.

The auto loan outstanding balance has almost doubled since 2010

Although the pandemic highlighted the auto loan industry’s outstanding balance, it is nothing new. Car and Driver cited the Federal Reserve Bank of St. Louis and noted that the overall outstanding value of auto loans has been on the rise consistently since 2010. While many factors contribute to this figure, a few stand out.

According to Kelly Blue Book, the average price of a car sold in June 2020 was $38,851. Sadly, the average cost of a new vehicle sold supersedes the national average income of $33,706, as reported by The U.S. Census Bureau. As a result, average Americans are utilizing longer auto loans to afford these more expensive cars. Unexpected instabilities such as the Covid-19 outbreak only highlight the deeper issue of high car prices and crushing debt.