Best Tips for What to Do Before Your Car Is Repossessed

It’s sad to say but for some car buyers, getting a car loan is gamed against them. This is especially true of those with low credit scores. And as we’ve shown, car dealers and also lenders end up making money from loans that end up in default. They’re good with low-credit buyers getting into a loan they know they can’t maintain. So before a buyer gets their car repossessed from default, what should they do?

What happens to you when your car is repossessed?

From 2011 to 2020, lenders repossessed between 15% and, in the case of Credit Acceptance Corporation, 35% of their car loans, according to Consumer Reports. For comparison, Ford Credit repossesses around 1% of its approved loans yearly. And just because there’s a car repossession, that doesn’t mean the buyer is off the hook for the loan.

Once the car is gone, lenders can begin garnishing wages and attaching tax refunds. If the lender goes to court and wins, they can also charge legal fees to the defendant. There is also interest accruing for the loan while a proceeding winds its way through the courts. So nothing good comes from a car purchase that compromises a buyer’s ability to make payments and needs the balance of his or her wages for the basics.

What you can do before your car is repossessed

Here are some tips to consider from consumer finance experts that will keep all buyers from getting buried in car loans they have no way of keeping up with.

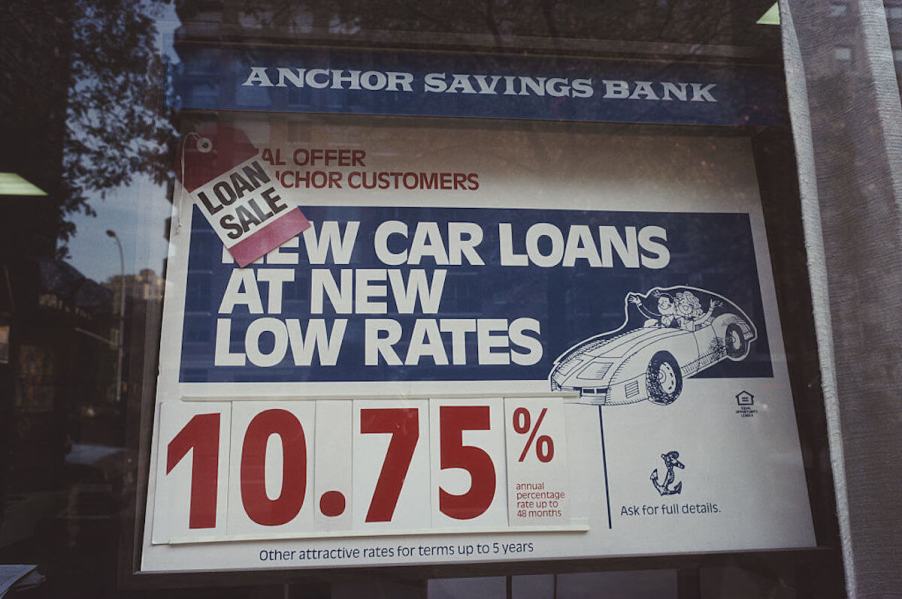

- Before going with a finance company, try to get a loan through a bank or credit union. Their interest rates are lower, and they won’t give loans to buyers that show they can’t keep up with high monthly payments.

- If you do use a dealer’s financing, negotiate not only the price but the loan terms. Most all low credit loans come with much higher interest rates.

- If you buy gap insurance when you sign your loan papers, if you get to a tipping point with your loan, cancel it and other purchase add-ons.

- No one says you have to keep your car if default is imminent. Sell it, and use the money you get to pay down the loan. You won’t be able to pay it off unless you sell for more than you paid for your car, but paying a portion of the loan may allow you to renegotiate the remaining loan amount.

- Though you may be past the point of no return, repossessors can’t snag your car if it is in a locked garage. It is illegal for them to cut locks. However, anything that repossessors do like using force, let them do their thing and call the police. You may also have to contact a lawyer.

There are programs to help low-income car buyers

There are places to go for low-income buyers. Subsidized loans from programs like Vehicles for Change, can help with its car ownership programs. Unfortunately, the program is only active in Maryland, Virginia, and Washington, D.C. Income and work requirements factor into those who can and cannot receive loans. How much savings one has, and the ability to afford insurance also are parameters. But loans can have monthly payments of under $100 a month.