This Chinese Company Is Dominating EV Battery Sales

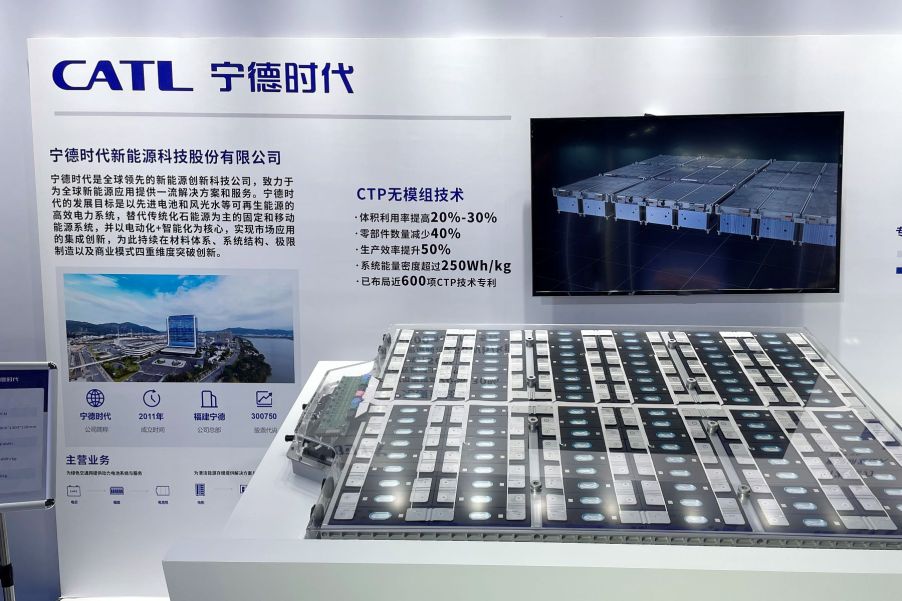

With the entire auto industry moving toward electrification, electric vehicle (EV) batteries are an increasingly important commodity and at the heart of it is a Chinese company. Contemporary Amperex Technology Ltd, or CATL, is a lithium-ion battery manufacturing battery based in Ningde, Fujian, China. The company has been dominating EV battery sales globally for the past few years, although that dominance now seems to be under threat.

CATL’s global EV battery market share

According to Bloomberg, the CATL held 37.1% of the global market share for EV car batteries between January and November 2022. This was up from 32.8% in the previous year. Its closest competitor was the Warren Buffet-backed Chinese company BYD with a 13.6% market share, while third place went to LG Energy Solution with 12.3%.

The company was founded in 2011, with the New York Times noting it has grown thanks to government subsidies and regulatory favor from China’s current regime. One example is when the Chinese government demanded that foreign car manufacturers who wanted to sell EVs in the country transfer crucial technologies to a local company. The government would then offer subsidies that made the EVs more attractive to local buyers.

Around 2015-2016, the government again changed the rules regarding subsidies. Now they would only be provided for cars with batteries from Chinese companies, which caught General Motors off-guard. At the time, it used South Korean LG batteries in its Buick Velite models for the Chinese market, which meant it had to ship back some of its vehicles and build them again.

Another example is when Chinese authorities dropped the nail test for testing batteries. It painted CATL’s lithium-cobalt products in a bad light since they exploded after being pierced. It was replaced by a test of whether the batteries could contain fires for at least five minutes.

Numerous financial bailouts have also allowed the company to retain its lead in the market.

Which car companies use CATL batteries

The Ningde-based company currently provides EV batteries to some of the world’s leading automakers. General Motors is a great example, having switched to the company’s batteries due to Chinese government pressure post-2016. Other global car manufacturers include the Nissan Motor Corporation and the BMW Group.

Currently, even Tesla gets its EV batteries from CATL, although according to CarExpert, a BYD executive may have let it slip that the automaker would soon switch providers.

Domestically, CATL supplies batteries to most of China’s EV manufacturers, with examples including Nio, GAC Group, Li Auto, XPeng, and Geely.

How new EV manufacturing laws in the U.S. have changed the landscape

The U.S. seems to be taking a page out of China’s playbook with its new EV tax plan. According to the World Economic Forum, there will be a $7,500 credit for passenger cars with a few caveats. One is that the credit will only be available for vehicles assembled in North America.

Regarding EV batteries, they must be made from at least 50% North American content, with the minimum threshold rising to 100% by 2029. Naturally, this puts CATL in a precarious position. With these laws coming into effect by January 2024, this could mean the end of CATL EV batteries in the U.S.

Furthermore, 40% of critical minerals used in EV batteries should be from the U.S. or a country with which it has a free trade agreement. Currently, these countries include Guatemala, El Salvador, Bahrain, Australia, Korea, Oman, and several others, with China conspicuously missing from the list. As such, this may even lock out Warren Buffet’s BYD investment from the U.S. market.