Elon Musk’s Impulsive Tesla Funding Tweets Might Cost Him

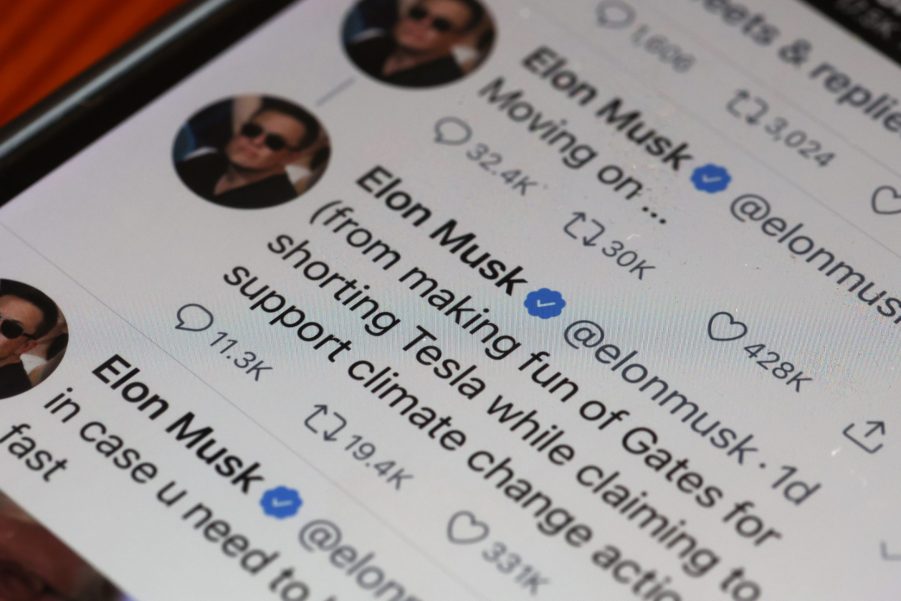

These days, Elon Musk’s tweets essentially function as Tesla’s PR department. But while the CEO’s Twitter account has kept people abreast of company updates, it’s also landed Musk and the automaker in legal hot water. Not just once, but multiple times. So, it shouldn’t be surprising why a newly-unsealed federal ruling has Musk in the hot seat again.

Federal judge finds Elon Musk’s 2018 “funding secure” tweets reckless and misleading

Today, Tesla is a publicly-traded company with stocks and everything. But in 2018, Elon Musk tweeted, “Am considering taking Tesla private at $420. Funding secured.” This set off a legal firestorm that ended with Musk being ousted as Tesla chairman and paying the Securities Exchange Commission (SEC) a $20 million fine. Furthermore, he agreed to have someone monitor his Twitter activity; a Twitter babysitter, if you will.

However, while that lawsuit was seemingly settled, that tweet’s aftershocks aren’t over. See, Musk sent that tweet while he was meeting with representatives from Saudi Arabia’s Public Investment Fund (PIF) to secure funding for taking Tesla private. But though the tweet claimed otherwise, “there was nothing concrete about funding coming from the PIF; rather, discussions between Tesla and the PIF were clearly at the preliminary stage.”

Those are the words of U.S. District Judge Edward Chen of San Francisco, who ultimately found Elon Musk’s funding tweets “inaccurate and reckless,” The Drive reports. Judge Chen actually issued his summary judgment on April 1st, 2022, but it was only recently unsealed.

Now, this new ruling doesn’t carry a fine or other punishment on its own. But remember that earlier SEC lawsuit? Well, it’s not the only lawsuit Elon Musk is currently facing that involves his tweets. And that’s where Judge Chen’s ruling could have a larger impact on Musk and Tesla.

Will this ruling impact the ongoing Tesla stock lawsuit?

As of this writing, Musk and JPMorgan are battling it out in the courtroom over Tesla stock price fluctuations. And that “funding secure” tweet is at the core of this legal battle.

It’s worth noting that although stock prices fluctuate as a matter of course, major current events often cause dramatic shifts. For example, when the NHTSA announced its Autopilot investigations, Tesla’s stock prices dropped by 10%. And they dropped again after Musk announced his plans to buy Twitter.

Yet while shrinking stock prices are usually bad for investors, they can also be financial opportunities. But not merely if you time it just right and sell stocks before prices drop, say, before a big recall announcement. What JPMorgan argues in its lawsuit is that Elon Musk’s tweets were a deliberate attempt to manipulate Tesla stock prices, The Drive explains. And if it wins, Musk is on the hook for millions.

Now, Judge Chen’s summary judgment didn’t include a ruling about whether that “funding secured” tweet truly affected Tesla’s stock. However, in past legal filings, the SEC stated that “’so long as Musk and Tesla use Musk’s Twitter account to disclose information to investors, the SEC may legitimately investigate matters relating to Tesla’s disclosure controls and procedures,’” the Wall Street Journal reports. In other words, at least in the SEC’s eyes, Elon Musk’s tweets are intimately tied to Tesla’s fortunes. And that has implications beyond just the automaker’s stocks and the potential JPMorgan lawsuit payouts.

Musk’s Twitter problems might continue

Elon Musk doesn’t just use Twitter anymore—he’s now angling to own the social medial platform outright. And while Twitter accepted his $44 billion offer on April 28th, 2022, the company’s shareholders still need to approve it, the WSJ notes. So, as of this writing, Musk hasn’t completed his Twitter takeover.

But if it goes through, that means Tesla and Twitter will be controlled by the same person. That’s unprecedented in the automotive world. Yes, Henry Ford owned newspapers, but he didn’t own the ability to print ink on paper. At the very least, this further muddies the waters swirling around Tesla, Elon Musk, and his tweets. And don’t forget, Musk is raising money for the deal using Tesla stock.

To paraphrase Judge Chen, that sounds reckless.

Follow more updates from MotorBiscuit on our Facebook page.