When to expect your car insurance premium to go up after a claim

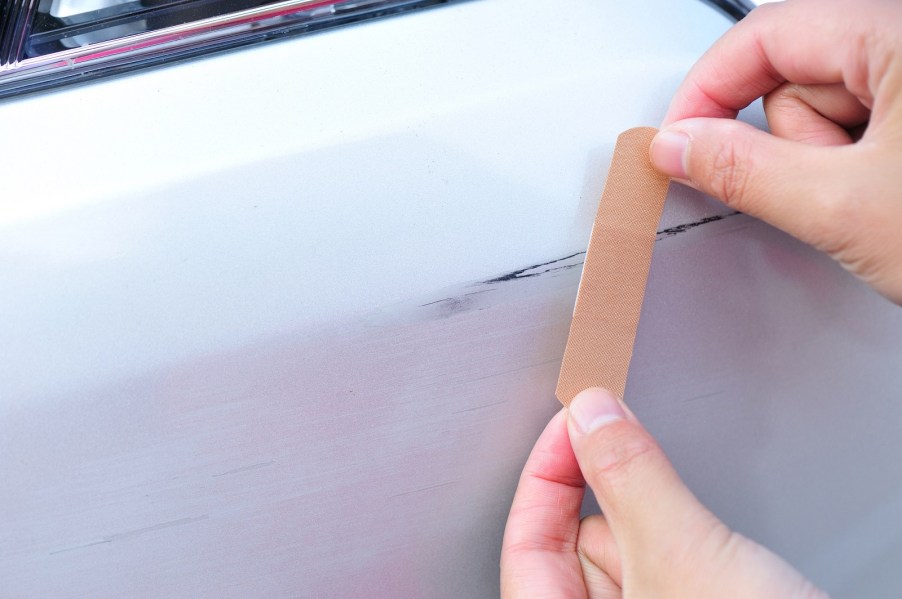

Drivers are often shy to file a car insurance claim after an “oopsie” because they fear a rate increase. They aren’t wrong; insurance companies will indeed bump up premiums after a claim based on a variety of factors. I sold insurance and maintained customer policies for a couple of years after college. Next, I processed insurance repair claims for more than a decade at a local shop. The threshold for raising car insurance rates after a collision or even a comprehensive repair claim can vary significantly between companies. However, several common factors influence this move. Let’s review six of them.

- Cost of the claim

- Assigned fault

- Claim history

- Type of claim

- State regulations

- Specific policy details

If the repair costs exceed a certain amount, typically between $500 to $2,000, the insurance company may consider raising your rates. As mentioned, I handled hundreds of car insurance repair claims. I’d recommend paying out of pocket if your deductible is close to the total repair bill.

For example, say you need a new front bumper cover and a left front headlamp. The estimate might be $1,300. If you have a $1,000 deductible, I’d recommend just paying the whole bill out of pocket. Don’t assume that you’re “saving” $300 by proceeding with a claim. If your rate increases, you’ll soon pay that $300 back – and probably more.

If you are found at fault for the car accident, your rates are more likely to increase. Some insurers offer “accident forgiveness” for your first at-fault accident, which is nice. We often repaired cars that minors drove and found their car insurance company “forgiving” the accident based on claim history and policy tenure.

Comprehensive claims (like those for theft or weather damage) might not affect your rates as much as collision claims, which are more likely to indicate risky driving behavior. However, your rate can still increase. Per Progressive, a history of multiple claims, even if they are not your fault, can also lead to higher rates. This is true even if you aren’t “at fault.” You might be considered a higher risk if you’re prone to being caught in situations leading to vehicle damage and medical bills.

Some states have regulations that limit how and when insurers can raise rates after a claim. This includes the conditions and percentage the rate may increase. The specifics of your car insurance policy, including the presence of safe driver discounts, can affect whether your rates will go up after a claim. Also, if you end up in a different vehicle after a claim that resulted in a total loss, your premium might go up based on your next car. Of course, it’s best to check with your insurance provider for their specific policies and thresholds.