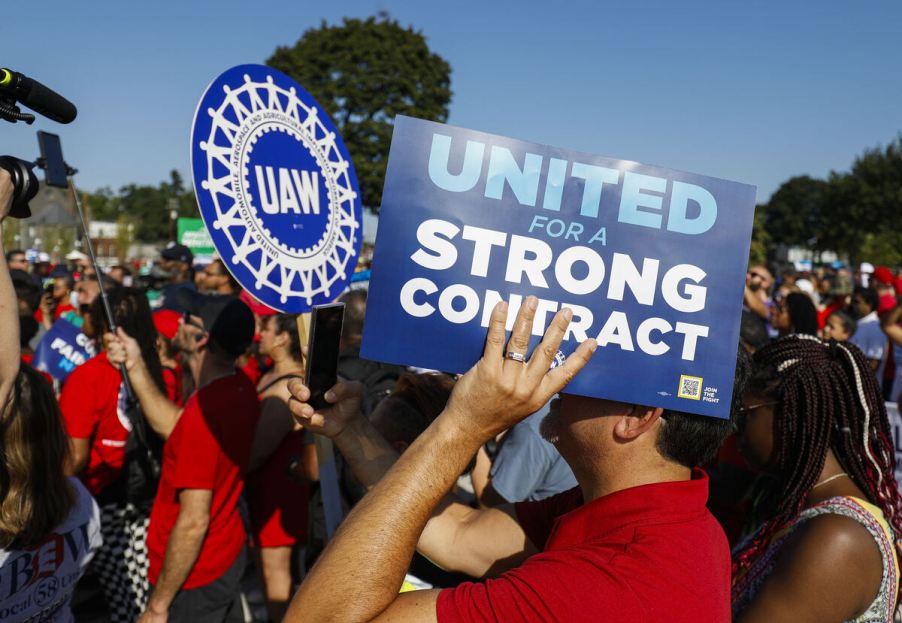

‘Growing Nightmare Situation’ EV Prices Increasing $5000 After UAW Strike

We try to stay away from controversies surrounding the current United Auto Workers (UAW) strike. But its implications will be far-reaching no matter how negotiations go. Now, a respected auto industry analyst is saying that new car prices are heading toward a “growing nightmare situation.” Higher labor costs translate to higher vehicle costs in general. However, having three variations, EV, PHEV, and gas-power versions of each model moving forward will be costly to automakers.

First, no matter what increasing vehicle costs come from the strike, wages are going up, according to Dan Levy, Barclay’s senior auto analyst. That won’t only affect union shops but also non-union ones like Tesla. That’s because if there is enough disparity, the non-union shops will vote to unionize. They’re already getting lower wages than union members, instead offsetting lower pay with company stock.

Will the strike affect non-union Tesla EV prices?

So, non-union companies like Tesla are preparing to increase wages at its plants because there is no way that stock options can make up for what the UAW is asking for, which is a 40% increase. Actually, Tesla is the only company that has non-union factories. So that puts even more pressure on it to seek parity.

However, the double whammy is the increasing development costs not only for EVs but also for developing and maintaining gas-power and PHEV versions. How do you split the marketing and advertising? And how much more complex is your parts distribution with three separate power systems for each model?

Because according to S&P Mobility, yearly sales volume must be between 40,000 to 60,000 units to make a profit. It says the expectation going into 2027 and beyond is that with three different versions of the same vehicle, not counting trims, volumes will drop to 36,000 vehicles. And that means quite a few models will not be profitable.

How are PHEV and gas-powered cars affecting EV prices?

So, to be sustainable while spending billions of dollars in development, automakers must now come up with a new way to address this proliferation of new powertrains. They are not at a point yet where they can just bonk the same body and interior onto differing power systems with a single platform.

And the longer it takes for EV adoption, the longer this scenario gets strung out. So, if car companies throttle back on their EV debuts, it will only hurt them. Matt Hardigree at Autopian says this is the reason the automakers have been dropping models like sedans and coupes.

With hybrids and EVs coming down the pike, there were too many models and not enough factories to make them. Of course, the waning interest in those models by buyers was a big reason as well. But it all churns together for car companies determining which models to save and which to kill.

How do UAW wage earners’ pay increases add so much?

Factoring around $8 billion in wage increases to amortize into products, around $3,000 to $5,000, is how much EV prices will rise. And this comes on the heels of cars drastically increasing in price since the pandemic. Most acknowledge many car buyers are being driven out of the new car market already.

Complicating things are automakers’ expectations for non-union battery manufacturing in the U.S., factoring into forecasts of costs in future EVs. The UAW is pushing hard to get the manufacturers to guarantee they’ll be union shops. If that happens, car companies are going to have to really sharpen their pencils to pull all of the points made here together while presenting a compelling product line for the next 10 years. That’s when expectations are that EVs will pretty much be the dominant vehicle around the world.