Jaguar, Audi, Mercedes Paying A Huge Price Tesla Isn’t

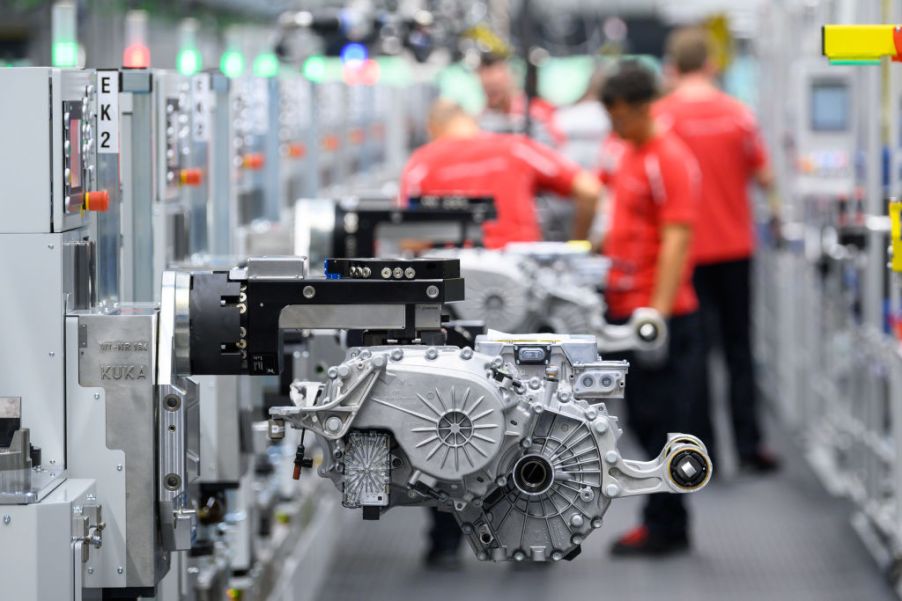

In their zeal to blast into electrification faster than light huge companies like Mercedes Benz and General Motors; and smaller manufacturers like Audi and Jaguar all rely on outside suppliers for much of their EV components. One main piece of the electric puzzle is batteries. LG Chem supplies the batteries to many EV manufacturers and now it can’t keep up. Quality control has been lax causing many bumps for Audi’s E-Tron and Jag’s I-Pace. Now Jaguar Land Rover has announced it is halting production of the I-Pace for a time as a result of battery shortages.

You might be thinking it’s due to the coronavirus since LG makes batteries in South Korea not too far from the virus’s origins in China. That could be the next domino to fall in the supply fiasco but it’s not where the problem arises. LG’s Wroclaw, Poland, factory is the culprit.

Audi, Jaguar, and Mercedes implicate battery manufacturer as the reason for slowing/stopping production

The plant has been implicated for the reason that the E-Tron, I-Pace and EQC production has been cut back or stopped altogether. LG Chem and Panasonic are just two of a number of suppliers having problems keeping up with demand.

Do you know one company that isn’t having battery supply problems? Tesla. Do you know why? Because it decided early on to get into the EV parade with both feet. Instead of using outside component suppliers for motors, batteries, and other assorted components it decided to make its own. That’s a huge difference.

Audi, Mercedes, Jaguar, and others were caught unprepared for the electric zeitgeist

The electricity zeitgeist caught all vehicle manufacturers unprepared. They all needed to ramp up development quickly-except for Nissan. It had the Leaf before the others. It just chose not to put any push behind it and let it sink or swim. It’s another blunder to review for another time.

So, while the car companies scramble like they never have before Tesla keeps capturing more market share and gleaning higher valuation as a result. It had the luxury of ramping up methodically because right before Detroit’s eyes it didn’t see Tesla as anything but a tech startup doomed to failure.

Accepted thinking in Detroit is those upstart companies all fail

The accepted thinking for the last 100 years in Detroit is that every car company started after WWII has failed. Kaiser, Tucker, DeLorean, Bricklin; and some you probably don’t know about like Davis, Playboy, King, Powell, and others. This doesn’t take into account some of the powerhouse companies before the war that died soon after. We’re talking Packard, Hudson, Nash, Studebaker, DeSoto and later Pontiac, Plymouth, and Mercury to name a few more.

So Detroit looks askance at upstarts. That’s why it didn’t give Tesla much credence. Now, things are different and all of them need a lifeline. Outside component manufacturers provide that. But when your outside supplier has problems it can seriously affect your volume as Jaguar is finding out. Not that the I-Pace was selling well.

The Jaguar I-Pace has had a bad track record so far

It has had its own problems that had very little to do with batteries. The software seemed to be the main issue. That. and a dealer network unable to properly diagnose problems as they arose because they were geared toward internal combustion Jags. It seems that Jag has most of those issues addressed. But that’s Murphy’s Law: If something can go wrong it will. Now that the software problems are mostly behind it, Jag has to deal with battery shortages and bad publicity. This won’t help.

And, if the coronavirus spreads to South Korea in any bad way the two LG Chem plants there will surely shut down add a massive problem for LG. While it’s great that with the help of outside companies manufacturers can cut down on development time it also means you lose a certain control over how and when you get the product. And as Jag is finding out it means you’re at the mercy of whichever supplier tips sideways.

The next time you look at how Tesla is valued over GM or Ford keep this in mind. There are other reasons why, and reasons why it shouldn’t be valued as much as it is. But, you can see when analysts smoke over a company it takes into consideration how it’s past decisions have handicapped profits.